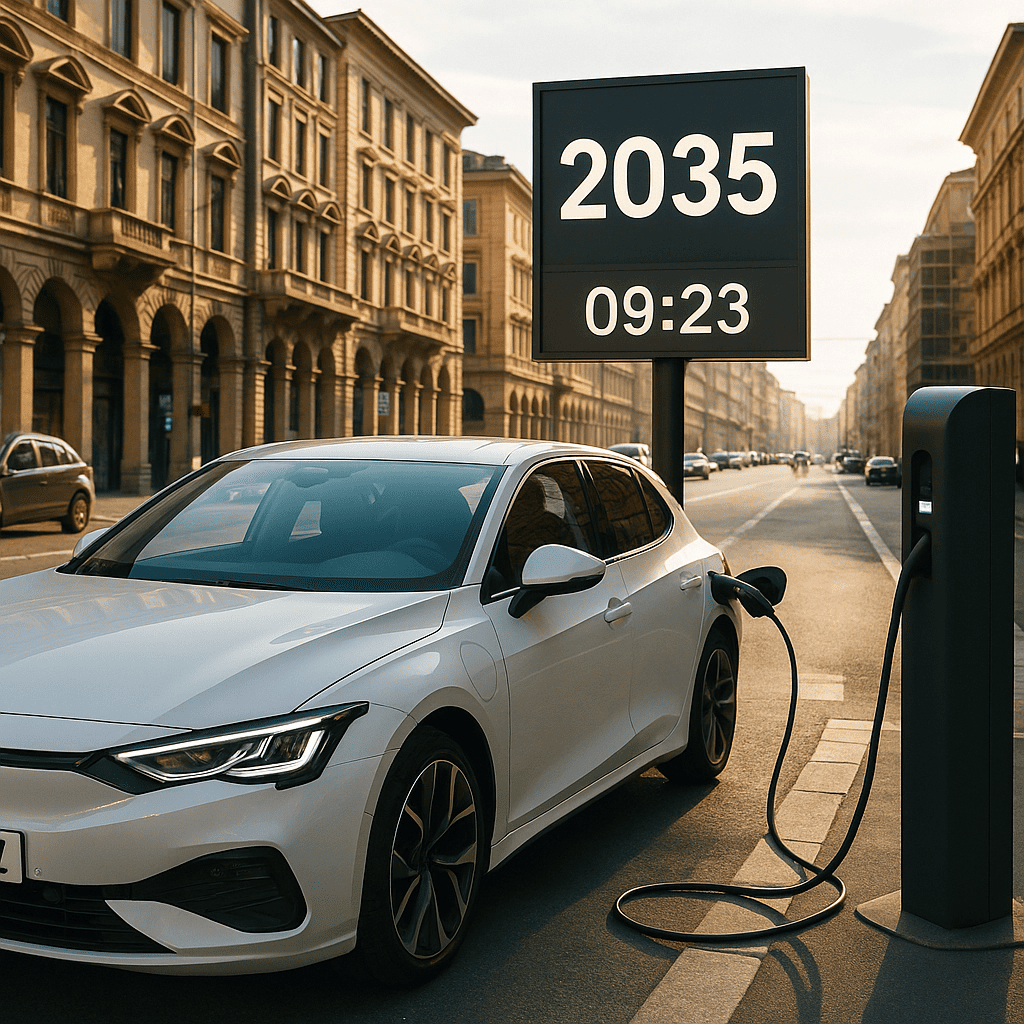

In 2022 the European Union agreed on a landmark regulation: from 2035, the sale of new passenger cars and light commercial vehicles with internal-combustion engines (ICE) will be effectively prohibited within the bloc. While plug-in hybrids may remain in limited niches and low-volume manufacturers can apply for exemptions, the message is clear—Europe’s road transport must be zero-emission within a single product cycle. This political deadline is now reshaping the entire automotive value chain, catalysing investment, innovation and consumer adoption far faster than market forces alone could manage.

The Legal Framework: From Fit-for-55 to Zero-Emission Mandate

The 2035 target sits inside the EU’s “Fit-for-55” climate package, which mandates a 100 % reduction in fleet-average CO₂ emissions for new cars compared with 2021 levels. Intermediate checkpoints—such as a 55 % cut by 2030—ensure manufacturers front-load electrification rather than postponing it. National governments reinforce the roadmap through tax incentives, registration bans and urban low-emission zones, making the ICE phase-out legally binding and practically unavoidable.

Industry Reaction: An Accelerated Electric Roadmap

Faced with a firm deadline, European OEMs have pulled forward EV launch timelines. Volkswagen targets 80 % electric sales in Europe by 2030; Stellantis plans to sell only battery-electric cars in the region by 2030; Mercedes-Benz aims to be “electric-only where market conditions allow” from 2025 onward. Suppliers are likewise pivoting: Bosch is investing €10 billion in e-mobility and hydrogen, while CATL and Northvolt are building multiple gigafactories on EU soil.

Infrastructure Boom: From Kilowatts to Megawatts

Ahead of 2035, public and private stakeholders are racing to deploy charging infrastructure. The Alternative Fuels Infrastructure Regulation (AFIR) requires fast chargers every 60 km on core TEN-T road corridors by 2026. Simultaneously, the Megawatt Charging System (MCS) for trucks is entering pilot phase in Germany and the Netherlands. Utilities are upgrading grids, and V2G pilots in Denmark and the UK illustrate how parked EVs will one day stabilise renewable-heavy electricity systems.

Consumer Uptake: Incentives, Mandates and Mindset Shifts

Purchase incentives—ranging from Germany’s Umweltbonus to France’s bonus écologique—continue to make EVs financially attractive. Meanwhile, total cost of ownership (TCO) parity has arrived for many segments: soaring fuel prices in 2022–23 and falling battery costs under €100 kWh mean a compact electric hatchback can now beat its petrol rival on five-year cost in most EU capitals. Public charging anxiety is dwindling as networks like IONITY, Fastned and Tesla Supercharger expand.

Supply-Chain Localisation and Critical-Raw-Material Strategy

To avoid trading oil dependency for battery-mineral dependency, the EU Critical Raw Materials Act incentivises domestic mining, refining and recycling. Projects in Portugal (lithium), Sweden (nickel) and Finland (cobalt sulphate) aim to anchor strategic materials within Europe. Simultaneously, battery passports—digital IDs tracking the provenance and carbon footprint of each pack—will become mandatory from 2027, increasing transparency and circularity.

Economic and Employment Impact

While drivetrain electrification threatens traditional engine and transmission jobs, it creates new roles in software, power-electronics and cell manufacturing. Studies by Transport & Environment estimate a net 200 000 job gain in Europe if battery production expands domestically. Retraining programmes in Germany’s auto heartlands and EU Just Transition funding aim to cushion workforce shifts.

Challenges: Grid Strain, Rural Roll-out and Affordability

Meeting the 2035 goal is not without hurdles. Rural regions risk slower charger roll-out; grid operators must reinforce distribution networks; and affordable (<€25 000) EV models remain scarce. Policy makers recognise these gaps—hence targeted subsidies for low-income buyers, mandatory plug-ready parking in new buildings and accelerated permitting for renewables.

Ripple Effects Beyond Europe

Europe’s zero-emission mandate exerts global pressure: manufacturers exporting to the EU must electrify line-ups; raw-material suppliers must meet ethical and environmental standards; and regions from California to Canada are contemplating similar 2035 bans. The European Commission’s regulation, once criticised as aspirational, is now setting the de facto timetable for the worldwide automotive transition.

Conclusion

The 2035 ICE ban is more than a regulatory milestone—it is a market-shaping catalyst accelerating every aspect of the electric-vehicle ecosystem. From factory floors to raw-material mines, grid planners to urban designers, stakeholders are working against the clock to deliver a zero-emission transport landscape. If infrastructure keeps pace, costs continue to fall and renewable energy scales as planned, Europe’s roads in 2035 will tell a success story of policy-driven innovation—and the internal-combustion engine will be a relic of the past.

lol ICE ban by 2035? seems silly AF 🙄

lol eu ban petrol cars by 2035? sounds cray👎👎

Hah, ya oil absolutly dont run out🤣

ice ban 2035? cool story bro 😁 but chargers? cost? nah..